Why Thomas McGee

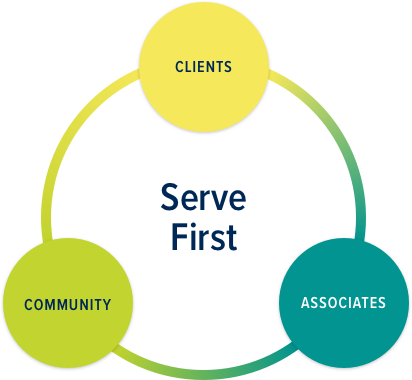

Our call to action is simple: SERVE FIRST. We serve our clients, communities and associates whenever, wherever and however. At Thomas McGee, we SERVE FIRST by putting others before ourselves.

-

We Serve Our Clients

We put ourselves in our clients’ shoes. We seek to be their trusted advisors. We develop deep relationships and serve our clients in extraordinary ways.

-

We Serve Our Associates

We are many associates, but we are one Thomas McGee Group. We celebrate, we suffer and we grow together. We are a reflection of one another and seek to represent ourselves with professionalism and humility at all times.

-

We Serve Our Community

We strive to be good neighbors, and to contribute to the common good. We use our resources to build relationships and be advocates for the positive progress of our communities.